If you’re considering working with an employer of record (EOR) you’re probably wondering what kind of legal issues you need to be aware of.

This guide will cover the most common legal issues with EORs. With the knowledge in this guide, you will be able to check off several compliance-related concerns, which will help you find an EOR that meets your requirements.

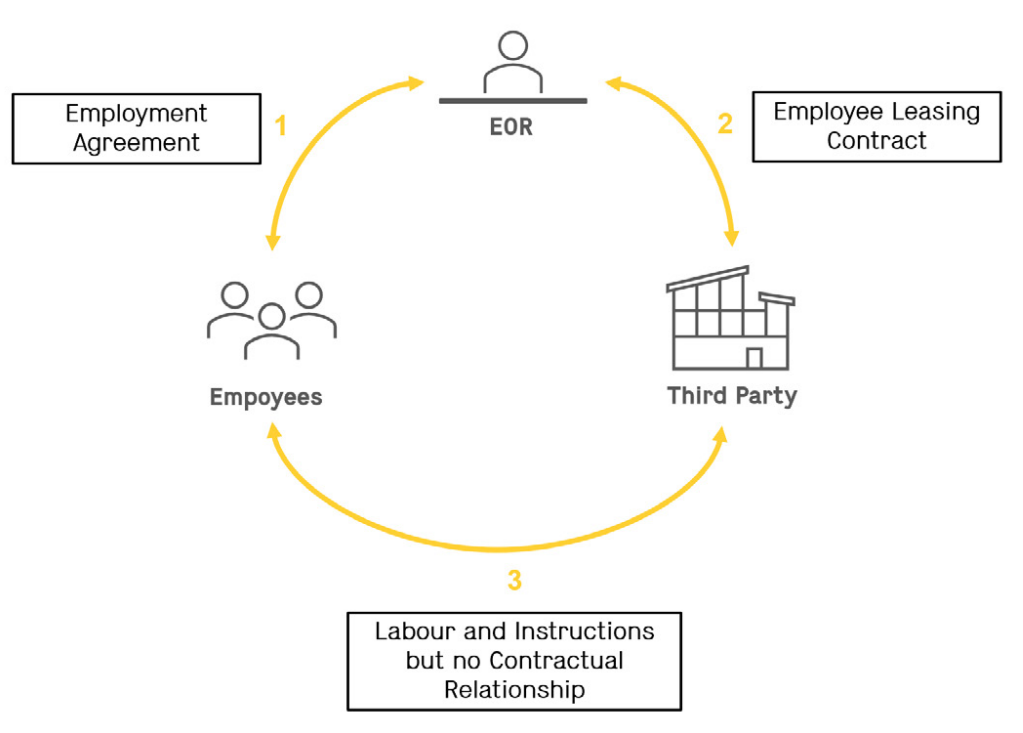

Employer of record (EOR) arrangements are effectively legal arrangements in which a company acts as the employer for a worker or group of workers, even though the worker is not formally employed by that company. EOR providers are often very knowledgeable about legal risk in the countries they operate. However, that does not mean that you should skip due diligence. Here are the legal risks to be aware of.

EORs need specialized legal expertise in the countries you plan to hire from

EOR providers need specialized legal expertise in the countries where they operate in order to navigate compliance with local employment laws, manage payroll and benefits, and handle employee-related legal issues.

This may involve obtaining visas and work permits for foreign employees, negotiating employment contracts, and handling tax and payroll issues. EOR providers may also need knowledge of other legal issues related to hiring and managing employees, such as labor laws, employee benefits, and employment disputes, in order to effectively assist their clients.

EORs also need to be aware of country-specific rules and regulations. For example, Sweden and Germany both have laws that impact hiring through an EOR. In both of these countries, hiring an employee through an EOR is considered “employee leasing” and each country has a set of rules that determine how long you can “lease” an employee for.

Some EORS claim to have direct in-country expertise when they really don’t

Some EOR providers claim to have direct in-country expertise, meaning they have their own local entities and staff in the countries where they operate, but this may not always be the case.

Some providers may only have a temporary foreign employer registration in the local market, meaning they do not have in-country staff and must rely on vendors and other resources to carry out their services.

It is important for organizations to verify the local presence and expertise of an EOR provider, as those with direct in-country expertise may be able to offer more comprehensive services and may be more reliable in terms of tax reporting and compliance.

Some countries have outlawed EOR arrangements

While EORs are perfectly legal in most countries, In some countries, EOR arrangements have been outlawed or heavily regulated due to concerns about worker rights and employment law compliance.

For example, in Mexico, EOR arrangements are now largely impossible due to a series of legal changes that have been implemented in recent years. These changes were aimed at protecting workers’ rights and preventing companies from using EOR arrangements to avoid their responsibilities as employers.

Similarly, the Philippines has long prohibited EOR arrangements, although enforcement of this prohibition has varied over time. In recent years, the government has taken a more aggressive stance on EOR arrangements, with stricter penalties for companies that use them to evade their responsibilities as employers.

Both Mexico and the Philippines have enacted these restrictions on EOR arrangements in order to protect workers’ rights and ensure that companies are held accountable for complying with employment laws and regulations.

It’s important to understand hiring remote workers from a country where EOR arrangements are effectively outlawed or thoroughly regulated should warrant discussion with your EOR’s legal team to minimize the risks.

Using an EOR does not guarantee you will not have PE risks

A permanent establishment (PE) is a fixed place of business through which a company carries on its business activities. If a company has a PE in a foreign country, it may be subject to tax on its income and profits generated through the PE.

Employer of record (EOR) arrangements, in which a company hires employees on behalf of another company, can create risks related to the potential creation of a PE.

If the EOR is deemed to be acting as an agent for the company or if the employees are deemed to be working for the company, the company may be considered the actual employer and be subject to taxes and costs associated with having a PE in that country.

The number of employees hired and the duration of their employment can also impact the risk of being deemed the actual employer and having a PE in a foreign country.

The type of work being carried out and the presence of independent contractors can also impact the risk of having a PE.

It is important for companies to understand the potential risks and obligations associated with having a PE in a foreign country and to seek legal advice as necessary.

Using an EOR does not guarantee you will not have co-employment risks

Co-employment risks refer to the potential legal and compliance issues that can arise when two entities share responsibility for an employee. Even if your EOR is the legal employer of your employee, you may still be deemed a co-employer in a court case.

In the context of using an employer of record (EOR) to hire workers internationally, co-employment risks may include liability for local HR, payroll, and tax withholding requirements, as well as potential breaches of the employment contract between the EOR and the worker.

Some countries, such as France and South Africa, have strict regulations around co-employment and may consider it illegal.

In order to avoid co-employment risks, it is important to carefully evaluate their employment partners and understand the nature of the employment arrangement, including whether the EOR is the sole legal employer or if co-employment is involved.

EORs have varying levels of IP protection

Intellectual property (IP) refers to the legal rights that protect creations of the mind, such as inventions, trademarks, and artistic works. Employer of record (EOR) providers may offer varying levels of protection for IP, depending on the nature of the services they offer and the terms of their agreements with clients.

In general, EOR providers may be responsible for protecting the IP of their clients in the course of providing employment-related services. This could include, for example, ensuring that employee contracts include provisions related to IP ownership and confidentiality, or providing guidance on IP registration and protection in the countries where they operate.

However, the level of IP protection offered by an EOR provider may vary depending on the specific terms of their agreement with the client. Some EOR providers may offer more comprehensive IP protection as part of their services, while others may offer limited or no protection.

Its important to carefully review the terms of their agreements with EOR providers and to seek legal advice as necessary to ensure that their IP is adequately protected.

Contractor misclassification is not always included

Contractor misclassification refers to the risk that a worker who is classified as an independent contractor may be reclassified as an employee by a government agency or a court. This can happen if the worker does not meet the criteria for independent contractor status, or if the company does not properly comply with the laws and regulations related to independent contractors.

If a worker is misclassified as an independent contractor, the company may face legal and financial consequences, including fines, penalties, and back taxes. In addition, misclassification can create risks related to employment law compliance, such as failure to provide required benefits or to follow proper wage and hour laws.

Employer of record (EOR) providers typically offer services that can help companies avoid contractor misclassification, such as guidance on compliance with employment laws and regulations and assistance with the proper classification of workers. However, this service is not always included in EOR packages and may come at an additional cost.

It is important for companies to carefully evaluate their need for EOR services related to contractor misclassification and to understand the terms of their agreements with EOR providers. Seeking legal advice can also be helpful in understanding the risks and obligations associated with contractor misclassification and in developing strategies to mitigate these risks.

Recommended EORs

Remote is a robust and modern platform for remote-first teams. EOR, contractor management, payroll, benefits, and more.

Oyster is an intuitive platform that allows you to hire, pay, and care for a global team in more than 180 countries. EOR, contractor management, payroll, benefits, and more.

TFY has features for applicant tracking, freelance management, payroll, and more in a single platform. The platform supports diversity hiring and Corporate Social Responsibility (CSR) initiatives.

Lano is both a B2B & B2C platform. Businesses can use it to process global payroll, hire remote talent and manage contractors, while employees and freelancers can benefit from its payslip service, invoicing app, multi-currency wallet, and more.