The main difference between PEO vs. EOR is that a professional employer organization (PEO) is a company that provides a range of human resource services to businesses. These services can include payroll, employee benefits, workers’ compensation, and other HR functions. An employer of record (EOR) is a company that acts as the official employer for employees of a business. This means that the EOR is responsible for things like payroll, taxes, and other employment-related tasks.

What is a professional employer organization (PEO)?

A PEO is a company that provides outsourced HR services to small and medium-sized businesses.

These services can include:

- Payroll processing

- Benefits administration

- Regulatory compliance

- Tax filings

The PEO acts as a partner to the business, providing support and expertise in these areas, but the business is still the official employer of its employees.

This means that the business is responsible for things like payroll, taxes, and other employment-related tasks. Working with a PEO can help businesses free up time and resources to focus on their core operations.

When you work with a PEO your company is still accountable for both legal and day-to-day operations. Including registering your business where you hire talent.

What is an employer of record (EOR)?

An employer of record (EOR) is a company that acts as the legal employer for employees of your business. An employer of record has legal entities in the countries you want to hire from.

The EOR is responsible for:

- Locality-specific onboarding

- Payroll

- Taxes

- Compliance

- Benefits administration

- Visa and relocation support

- HR-related employee support

EORs typically provide these services to businesses that need help with hiring employees in a particular location, often in a different country, or for a specific project.

By using an EOR, businesses can outsource many of the administrative tasks associated with employment, allowing them to focus on their core operations.

EORs are often used by businesses that are looking to hire employees in a new location or that do not have the resources to handle all of the employment-related tasks themselves.

If you want to hire remote employees without an EOR you will need to set up your own business entities in other countries.

PEO vs. EOR: key differences

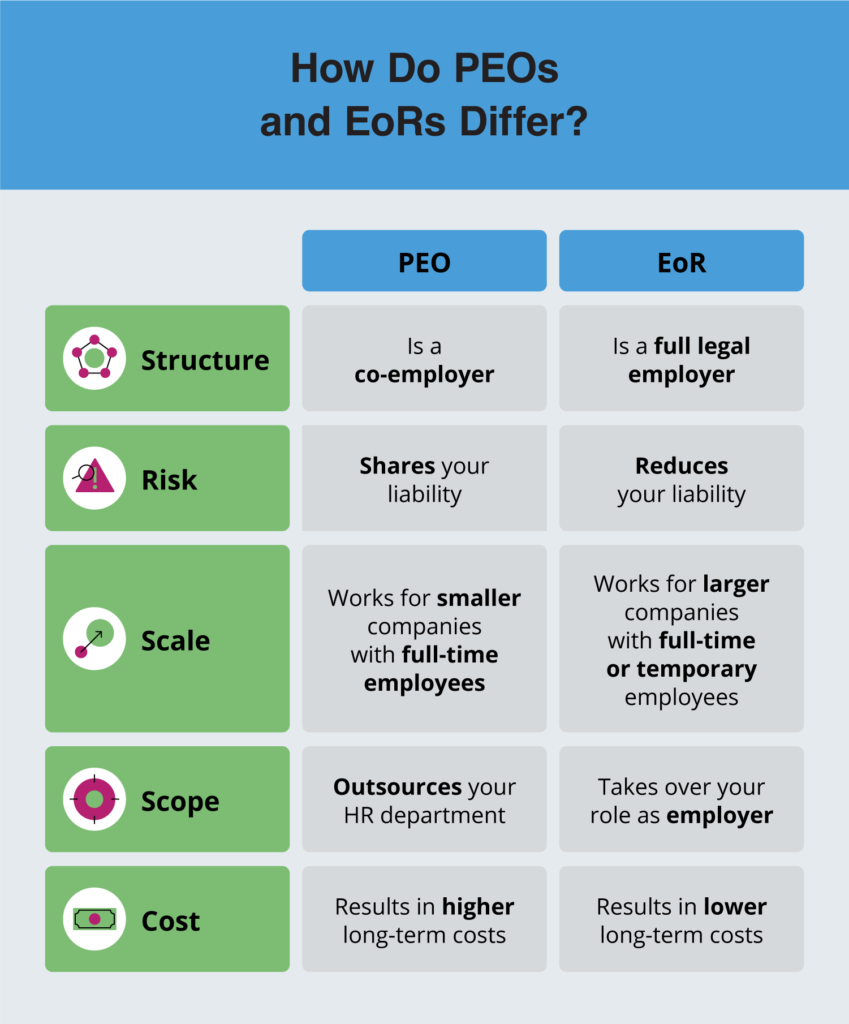

Main difference

A PEO is a company that provides HR services to businesses, acting as a co-employer. This means that the PEO helps with tasks like payroll, employee benefits, and other HR functions, but the business is still the official employer of its employees.

An EOR, on the other hand, is a third-party company that employs the workers of a business in locations where the business does not have its own entity. This means that the EOR is responsible for things like payroll, taxes, and other employment-related tasks. By working with a PEO, businesses retain control over HR-related decisions, while working with an EOR means giving up some control over these decisions in exchange for access to local expertise and benefit plans.

Long-term direction considerations

The relationship between PEOs and businesses is different from the relationship between EORs and businesses. PEOs act as co-employers, providing HR services to businesses and working closely with them over the long term. This means that PEOs are well-suited for businesses that want to hire full-time, permanent employees.

On the other hand, EORs are better suited for businesses that need to hire remote, seasonal or temporary employees, independent contractors, or employees for specific projects. Especially in other countries. Since EORs are experts in local labor laws, they can help businesses avoid the risks associated with hiring and managing employees in different locations. This can be especially useful for businesses that don’t have the resources or expertise to handle these tasks themselves.

EORs assume all the risk

A PEO (Professional Employer Organization) acts as a co-employer, meaning that your organization will still have exposure to employment liabilities, although a PEO can help manage those risks.

In contrast, An EOR, or Employer of Record, acts as the actual employer of your workforce and assumes all employment risks and liabilities related to the services it offers. This means that your organization will not have to worry about employment liabilities such as workplace safety.

PEOs are easier for larger organizations

A PEO (Professional Employer Organization) may be more beneficial for companies with larger, full-time staff, as it acts as a co-employer and takes on HR-related tasks. PEOs may also require a minimum number of employees in order to offer certain benefit packages.

An EOR (Employer of Record) offers more flexibility for companies that rely on temporary employees or need access to talent in different locations and countries. EORs are also less likely to have minimum employee requirements, allowing companies to hire just one employee in a given region.

Consider the services you need to outsource

If your business already has an entity in a given location, a PEO (Professional Employer Organization) partner can offer HR services in that area. However, because a PEO does not actually employ your workforce, your company is still responsible for complying with local labor laws.

An EOR (Employer of Record) partner, on the other hand, has comprehensive knowledge of local hiring practices and laws, which can make it easier for your business to expand into multiple states or countries without worrying about compliance issues.

EORs are more flexible than PEOs

While EORs (Employer of Records) generally handle fewer HR functions than PEOs (Professional Employer Organizations), the responsibilities they do handle for companies can often be more complex.

Additionally, some PEOs do not accept companies with fewer than 10 employees as clients, while EORs are typically more flexible and willing to work with small companies.

Small businesses and startups may also prefer EORs due to their ability and experience in overseeing temporary employee or independent contractor arrangements.

Cost differences for PEO vs EOR

PEOs (Professional Employer Organizations) and EORs (Employer of Records) both typically structure their rates with up-front and long-term costs, often charging a flat monthly fee per employee or a percentage of monthly payroll.

PEOs may also have a one-time introductory charge to set up services. However, an EOR typically costs less than a PEO in the long term. This is because an EOR covers insurance and benefits for your distributed workforce, saving your organization additional money and time, whereas, with a PEO, you would still be responsible for these costs.

PEO vs. EOR: how to decide

If your small business is looking to expand into new locations, partnering with a PEO (Professional Employer Organization) can help manage HR-related tasks and ensure compliance with local labor laws.

An EOR (Employer of Record) can also simplify the hiring process and take on responsibility for labor law compliance when hiring employees in multiple locations.

Both options can save your business time and money while allowing you to focus on your core operations. However, you will need to set up your own business entities in the countries you want to hire from if you decide to work with a PEO.

PEOs typically have employee minimums, EORs don’t

One key difference between the two is the minimum number of employees required to use their services. Most PEOs require a minimum of five to 10 employees, while EORs typically do not have a minimum requirement.

This makes EORs a good option for small businesses and those with fluctuating or contractor-based workforces. PEOs, on the other hand, are better suited for businesses looking to hire many employees in a new location, as they can help manage HR functions through a co-employment arrangement.

PEO vs. EOR: Insurance coverages

Insurance coverage is an important consideration when choosing between a PEO and an EOR. While EORs typically provide general liability (GL) and workers’ compensation (WC) insurance, PEOs may require you to provide your own insurance. This is particularly important to consider if your business is in a non-clerical industry, as PEOs may have difficulty securing WC insurance for these types of businesses.

EORs can provide peace of mind by ensuring that the employees they oversee are covered for damages and workplace-related illnesses or injuries. It’s important to carefully consider the insurance options available when choosing between a PEO and an EOR.

You need legal entities in the country you want to hire from

If you want to employ full-time workers in a country where you don’t have a legal entity, you must use an employer of record (EOR) to do so. This is your only option if you do not want to open your own legal entity in that country. In some cases, you may be able to pay workers as contractors, but you must carefully consider the nature of the relationship to avoid misclassifying employees as contractors. Alternatively, you can always open your own legal entity, but this can be a time-consuming and expensive process.

If you already have a legal entity in the country where you want to hire employees, but need help managing HR functions for those employees, a PEO (Professional Employer Organization) can provide services such as payroll and benefits. This can be useful for businesses that don’t have the resources to meet all of their employees’ needs in a new location.

When choosing between an EOR and a PEO, be aware that some EORs work through third parties to employ workers in other countries instead of doing so directly. This can lead to a confusing and expensive experience for both employees and employers. It’s best to choose an EOR that owns its own legal entities in the countries where it offers services. This ensures a better experience for employees and more predictable pricing for the employer.

Hiring full-time employees vs. contractors

You don’t need an EOR or a PEO to work with international contractors. Instead, you simply need a compliant contractor management and payment solution.

EOR services typically include a platform that makes it easy for you to pay and manage contractors all over the world. While a PEO will typically have people to delegate contractor HR tasks to on your behalf.

PEO vs EOR: Which should you choose?

If you don’t want to set up a business entity in other locations, choose an EOR.

If you want to be the legal employer of your remote hires, and set up your own entities, and you just need help handling the HR aspects, a PEO is a better option.

If you want to hire a few employees remotely In multiple locations, an EOR can help do it quickly and cost-effectively.

Regardless of whether you choose a PEO or an EOR, hiring top talent overseas can be a complex and challenging process.

Adhering to unfamiliar labor laws and regulations can be difficult and costly, and a lack of compliance can lead to regulatory issues, fines, or penalties, and a loss of the talent you set out to hire.

To avoid these issues, it’s important to have a thorough understanding of local labor laws and regulations and to work with a partner who can help you navigate these complexities.